In 2023, the overall gaming market had been experiencing a pullback after its peak during the pandemic. Economic turmoil and slump also constituted a further challenge to game developers. There were two major marketing trends in the global mobile games market: a rising number of advertisers, and increases in the proportion and number of new creatives.

Mobile game advertisers grow by 50%, and Southeast Asia becomes the most competitive market

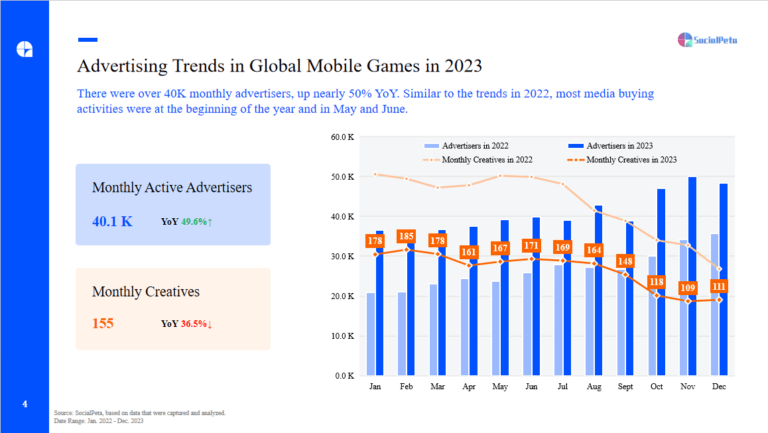

There were over 40K monthly mobile game advertisers in 2023, up nearly 50% YoY. Similar to the trends in 2022, most media buying activities were at the beginning of the year and in May and June, followed by a decline towards the end of the year.

Advertising trends

Source: SocialPeta

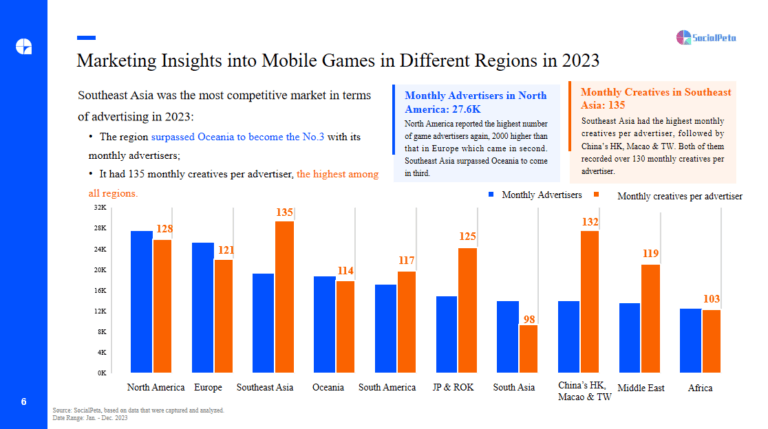

Considering the marketing insights into mobile games in different regions in 2023, Southeast Asia has indeed become the most competitive market in 2023:

Marketing insights into mobile games

Source: SocialPeta

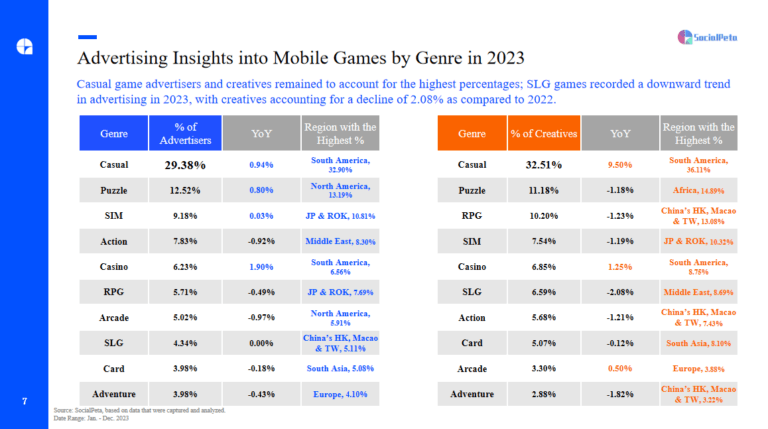

Casual games continue to have the highest proportion of advertisers and creatives, with the proportion of casual creatives increasing by 9.5% compared to last year. SLG games are undoubtedly the genre with the most significant marketing contraction in 2023; while the proportion of advertisers remains almost the same as in 2022, their share has decreased by over 2%.

Advertising insights by genre

Source: SocialPeta

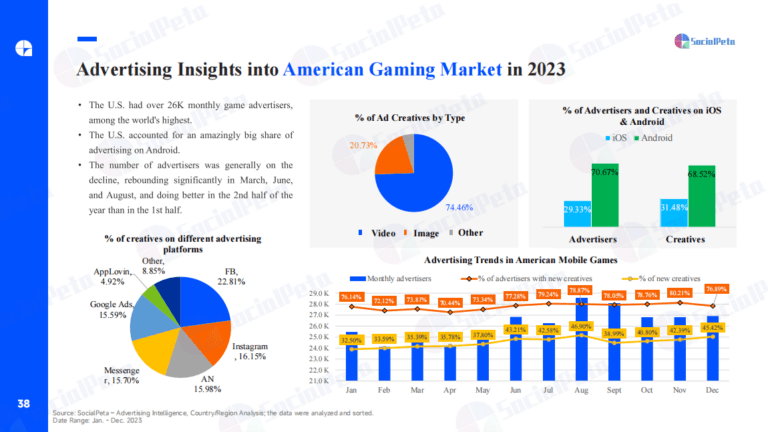

US mobile game advertising remains the highest; RPG game creatives focus more on gameplay display

In 2023, the monthly mobile game advertisers in the United States exceeded 26K, far surpassing other countries/regions. Among them, Android has already taken a dominant position in the U.S. mobile game market, with advertisers accounting for over 70% and creatives amount exceeding 68%.

Advertising insights into American gaming market

Source: SocialPeta

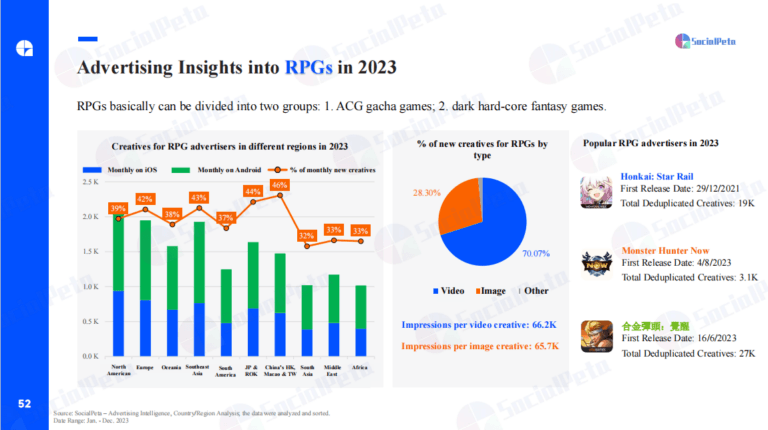

In popular game genres, RPGs are undoubtedly the most outstanding genre this year. The average monthly number of RPG advertisers is around 1,4K. The proportion of new RPG creatives each month exceeds 35%, with China’s Hong Kong, Macau, and Taiwan experiencing the fastest speed in releasing new RPG creatives, where the average monthly proportion exceeds 46%.

Advertising Insights into RPGs

Source: SocialPeta

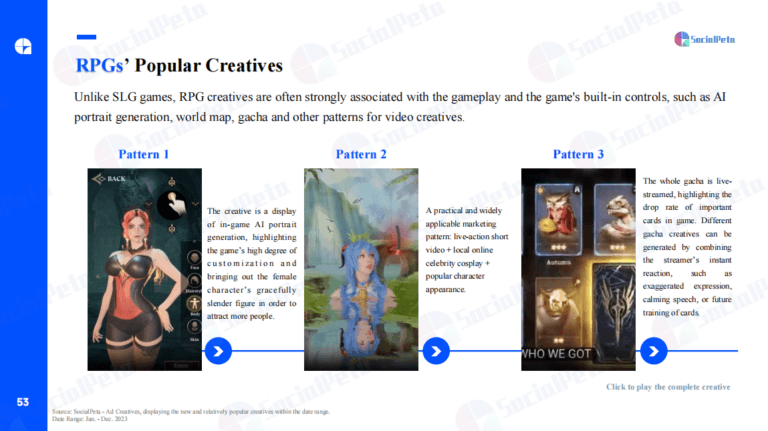

Regarding popular creatives for RPG games, many advertisers focus on showing the gameplay and the game’s built-in controls, such as AI portrait generation, world map, gacha and other patterns for video creatives.

RPG’s popular creatives

Source: SocialPeta

RPG’s popular creatives

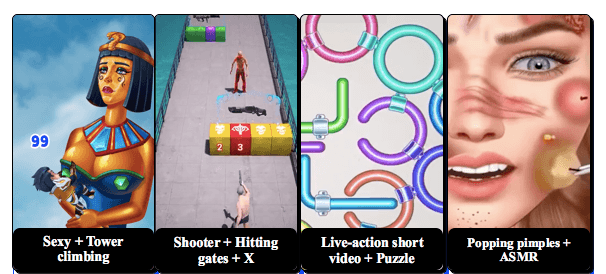

Since mini-game advertising was first applied, game companies have been bothered by problems including gamer fraud, poor union with main gameplay, dissatisfactory user acquisitions, and low user retention rates.

Mini-game ad creatives

Source: SocialPeta

Additionally, this whitepaper reviews the marketing performance of Honkai: Star Rail, Arena Breakout, MONOPOLY GO!, and Block Blast! in 2023.